September 23, 2013

The Fed Has Lost Its Cred 09.23.2013

Posted in Federal Reserve, Markets, Robert Barone, Uncategorized tagged employment, Robert Barone at 7:59 PM by Robert Barone

NEW YORK (TheStreet) — After nearly eight years of trying to make the Federal Reserve more transparent, in one stroke Chairman Ben Bernanke has undone much of that effort.

In May, he telegraphed the “taper” of the Fed’s “Large Scale Asset Purchase” program (known as LSAP to Fed economists and quantitative easing, or QE, to Wall Street) based on a strengthening economy and labor market.

The market reacted by pushing 10-year Treasury yields to nearly 3% from 1.6%, one of the most rapid backups in yields on record. Then, in the face of that strengthening economy and labor markets, last Wednesday, Bernanke pulled the rug out.

The Data: Except for the Bureau of Labor Statistics’ (BLS) August unemployment report, almost all of the underlying data underscore a strengthening economy. Both ISM manufacturing and non-manufacturing indexes for August were strong, with the non-manufacturing index setting a record high. The employment sub-indexes were no exceptions. Initial unemployment claims have been in a steady and steep downtrend since 2010.

The week of Sept. 7 saw this number at 294,000, a number not seen since April 2006. The four-week moving average, considered more reliable, at 314,750, hasn’t been this low since October 2007. The Fed’s own economists have indicated that concerns over “structural” employment issues (i.e., labor force drop-outs) have been overdone. Job openings in the private sector are higher than at any time since 2008, and employers complain they cannot find qualified candidates.

Thus, based on labor market conditions, which Bernanke indicated was key, in conjunction with the lack of success of the LSAP programs in stimulating economic growth (also according to the Fed’s own economists), the “taper” should have occurred.

After months of “taper” talk and years of trying to promote transparency, last Wednesday, something else happened. We don’t know what it was — yet. Maybe we will find out soon, or maybe we will have to wait for Bernanke’s memoirs.

Here are some possibilities:

•The Fed misread the August employment report. This doesn’t seem possible. As outlined above, all of the underlying employment data are much stronger, not weaker than last spring. Also, the Fed knows that the BLS heavily massages the employment releases.

The concurrent seasonal adjustment process used by the BLS, where each month the entire year’s series is recalculated but not released to the public, makes it not only possible but highly probable that the weaker August release simply reflected catch-up from the frail first and second quarters. So, while the August BLS numbers could be used as an excuse, they surely cannot be the underlying reason.

•The market reaction to the May “taper” announcement was more than the Fed anticipated and interest rates backed up too fast. The Fed may be concerned over the impact of higher rates on the nascent housing recovery. After all, the QEs seem to be aimed squarely at housing (the purchase of Mortgage Backed Securities in QE3) and the equity markets. But if this were the case, the Fed could easily jawbone rates lower, even in the face of the initial taper. In fact, many market pundits thought that rates would fall if the “taper” amount was as anticipated ($10 billion to $15 billion).

•There is a third possibility, one that is purely speculative on my part: Bernanke has decided that he wants another four-year term as chairman. Of course, that requires a White House nomination. Recognizing that nothing happens in Washington that isn’t manipulated or controlled, the events of the past 10 days surrounding the Fed seem too coincidental not to be related.

It is clear that while the markets want Janet Yellen to be the next Fed chair, the White House is not keen on her. Perhaps the “no-tapering” announcement was the quid pro quo between Bernanke and the White House and that Lawrence Summers’ formal withdrawal of his name from consideration (quite unusual, since there was no formally announced candidate list) was part and parcel. After all, a rising stock market is always desirable for the White House’s occupant.

Conclusion: History will eventually sort all of this out. Meanwhile, one thing is clear: The eight years of effort to make the Fed more transparent and credible have been dealt a serious blow. Last Wednesday, with the “no-taper” announcement, the Dow Jones Industrial Average rose 147 points. Since then, it has fallen 226 points, with a loss of 185 on Friday, as the markets have begun to rethink the implications.

In the end, without Fed credibility, markets will be more uncertain and, therefore, more volatile.

Robert Barone (Ph.D., economics, Georgetown University) is a principal of Universal Value Advisors, Reno, a registered investment adviser. Barone is a former director of the Federal Home Loan Bank of San Francisco and is currently a director of Allied Mineral Products, Columbus, Ohio, AAA Northern California, Nevada, Utah Auto Club, and the associated AAA Insurance Co., where he chairs the investment committee. Barone or the professionals at UVA (Joshua Barone, Andrea Knapp, Matt Marcewicz and Marvin Grulli) are available to discuss client investment needs.

Call them at 775-284-7778.

Statistics and other information have been compiled from various sources. Universal Value Advisors believes the facts and information to be accurate and credible but makes no guarantee to the complete accuracy of this information.

Enjoy the party, but beware of the hangover 09.22.2013

Posted in taxes, Uncategorized, Wall Street tagged economy, Robert Barone at 7:07 PM by Robert Barone

Despite what was widely viewed as a weak employment report in early September, the U.S. economy appears to be on solid footing. Both ISM manufacturing and nonmanufacturing indexes for August were strong, with the nonmanufacturing index setting a record high. Initial unemployment claims have been in a steady and steep downtrend since 2010. Job openings in the private sector are higher than at any time since 2008, and employers complain they cannot find qualified candidates. So, while we aren’t quite in a boom, put any thoughts of recession on the back burner. But, make no mistake, inflation lies ahead.

Political gridlock

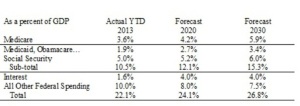

The No. 1 reason for this inflation forecast is the inability of governments at all levels, but especially the federal government, to rein in spending. At least once each year, we are treated to a confrontation between left and right over budgeting, spending and the deficit. But, nothing is ever resolved — the can is just kicked further down the road. The table above uses Congressional Budget Office baseline forecasts, which are quite optimistic. The table displays the baked-in growth in federal spending as a percentage of total economic output (gross domestic product).

Sources: Heritage Foundation; Jeffrey Gundlach/Doubleline Funds; U.S. Debt Clock website; Congressional Budget Office

2020 is only six years away, and 2030 but 16. From 1959-2008, the average revenue of the federal government as a percentage of GDP was 18.1 percent. For 2013, year to date, it is 16.9 percent. To balance the budget in the next six years, current tax rates must rise 43 percent. To balance it by 2030, those tax rates have to rise 59 percent. And these data points come from optimistic CBO forecasts. In an economy that the Fed considers so sluggish so as to not start its “taper” process, it is unlikely that taxes can be raised to these levels. Furthermore, the middle class, which pays most of the taxes, is rapidly shrinking due to the stealth inflation that has sapped their purchasing power. And, of course, the political chasm and resulting gridlock between the left and right has made addressing the automatic growth in federal spending essentially impossible.

The big story of the week was the fact that the Fed decided to keep the pedal to the metal (the “no taper” announcement) and the rapid growth in its balance sheet, which, essentially, is the creation of money that the banking system can lend several times over, continues unabated at $85 billion per month. Wall Street, the main receptor of the Fed’s largesse, sent the equity averages to all-time highs. But the Fed’s credibility took a hit, especially since the chairman telegraphed the “taper” way back in May. The very next day (Thursday), both jobless claims and existing home sales showed a much stronger underlying economy than expected. The markets now are questioning the Fed’s ability to even read the underlying trends.

Since the financial crisis, the Fed’s balance sheet has grown about $3 trillion, from about $800 billion to more than $3.6 trillion. During that same time period, U.S. Treasury debt outstanding has grown from $10 trillion to $17 trillion. In effect, the Fed has “monetized” 43 percent of the new debt over this period. Given the growth in automatic federal spending, it appears that monetizing the debt will be a major function of the Fed.

Conclusions:

• The economy is stronger than the Fed thinks and the unemployment report intimated.

• This is the first Fed in modern history to advocate higher rates of inflation (2.5 percent). Don’t be fooled; do you think that when the official CPI reaches 2.5 percent, it will automatically stop there because that is the Fed’s target?

• The rapid growth in automatic federal spending over the next few years will require the Fed to continue its large-scale asset purchases, just to support the Treasury’s need to issue debt and to keep interest rates down. Otherwise, the cost of interest alone will overwhelm the federal budget. The alternative, much higher taxation, is not politically viable.

• Ultimately, the dollar will weaken as the world recognizes that dollar debasement is occurring. Note that on the day of the Fed “no taper” announcement, gold rose by $55 an ounce. Market players aren’t stupid.

• Meanwhile, enjoy the continuation of the Wall Street party. But, beware of the inflation hangover.

Robert Barone (Ph.D., economics, Georgetown University) is a principal of Universal Value Advisors, Reno, a registered investment adviser. Barone is a former director of the Federal Home Loan Bank of San Francisco and is currently a director of Allied Mineral Products, Columbus, Ohio, AAA Northern California, Nevada, Utah Auto Club, and the associated AAA Insurance Co., where he chairs the investment committee. Barone or the professionals at UVA (Joshua Barone, Andrea Knapp, Matt Marcewicz and Marvin Grulli) are available to discuss client investment needs.

Call them at 775-284-7778.

Statistics and other information have been compiled from various sources. Universal Value Advisors believes the facts and information to be accurate and credible but makes no guarantee to the complete accuracy of this information.

September 9, 2013

Real Employment Numbers Portend Inflation 09.09.2013

Posted in Inflation, Uncategorized tagged Robert Barone, unemployment at 6:08 PM by Robert Barone

One of the most lamented statistics coming out of the employment data is that the shrinking labor force participation rate, not increased hiring, is causing the fall in the unemployment rate. Does this foreshadow a weakening economy? When raw data are manipulated, massaged and sent through computer systems that smooth, enhance and add and subtract from that data, their monthly movements are unlikely to be meaningful.

Massaged Data

As John Williams of Shadowstats.com has documented, we know we can’t believe the CPI-U as a measure of the cost of maintaining a standard of living, so why would we put a lot of credence in the monthly movement of the heavily massaged employment release?

After all, the Bureau of Labor Statistics employs a “Birth-Death” model that originated in the 1990s, which adds about 50,000 jobs per month because the sampling process does not adequately cover small business. Unfortunately, today’s economic conditions are different than those of the 1990s.

The BLS also recalculates seasonal factors every month (called “concurrent seasonal adjustment”). The process actually changes all of the past monthly data year to date. So, the September release of the August data actually changed all of the employment numbers back to January.

However, the BLS only reports two previous monthly revisions. As a result, it is possible that their latest data are simply catching the weakness of the first two quarters. Because of the data manipulation, it is highly unlikely that the employment numbers could catch a turning point in the economy.

Unmassaged Data

Rather than looking at the U.3 or U.6 unemployment series to get a gauge on the underlying employment strength, it may be more beneficial for investors to look at other employment data that is unmassaged.

The August ISM Manufacturing Index was 55.7 (49.0 in May, 50.9 in June, and 55.4 in July). Anything over 50 means expansion. The Employment sub-index was 53.3, down slightly from July’s 54.4, but up significantly from June’s 48.7.

The ISM Non-Manufacturing Index was 58.6. This is the highest reading in the history of the series (began January, ’08). The sub-index for employment in this series rose to 57.0 from 53.2 in July, and now showing growth for 13 straight months.

Initial claims for unemployment have been in a steady and steep downtrend since 2010. For the week of Aug. 24, they were 323,000. A year ago, they were 368,000, and over 400,000 in 2010 and 2011.

Just as a reference, this series was at the 320,000 level in 2007. A look at the continuing claims series shows a similar downtrend.

The JOLTS Report (Job Openings and Labor Turnover Survey) for the private sector shows a steep rise in job openings, now higher than at anytime since 2008; voluntary quits are on the rise; and layoffs and discharges are near the lows for the life of the index, which began in December 2000.

In the employment report itself, the workweek expanded by 0.1 hours and overtime jumped by 0.2 hours. In addition, average weekly earnings rose 0.5% in August (these are unmassaged data points).

There are two significant comments in the Fed’s just released Beige Book, a summary of trends from early July through late August, worth noting: 1) “Some firms have become increasingly willing to negotiate salaries;” 2) “Reports from a few Districts highlighted significant labor supply constraints, and, in some cases, large compensation increases for workers with specialized skills …”

Conclusions

When the whole picture is viewed: 1) there is a shrinking labor force; 2) aggregate demand is increasing; 3) skills are unavailable to fill the job openings (specialized skills are at a premium); 4) wages are beginning to rise; and 5) new investment by corporations over the past five years has been at at a five-decade low (they’ve kept it all in cash). This is a recipe for wage-induced, cost-push inflation and shrinking corporate margins.

Despite the employment report, the labor market has tightened and the economy is growing; as a result, expect the Fed to announce its “tapering” plan next week.

As we found out in the 1970s, once started, cost-push inflation is hard to contain. The Fed may soon get its wished-for 2.5% inflation rate (even using the downwardly biased CPI-U measure). However, the wage-induced inflation is not likely to stop at 2.5%, just because that is the Fed’s target!

Robert Barone (Ph.D., economics, Georgetown University) is a principal of Universal Value Advisors, Reno, a registered investment adviser. Barone is a former director of the Federal Home Loan Bank of San Francisco and is currently a director of Allied Mineral Products, Columbus, Ohio, AAA Northern California, Nevada, Utah Auto Club, and the associated AAA Insurance Co., where he chairs the investment committee. Barone or the professionals at UVA (Joshua Barone, Andrea Knapp, Matt Marcewicz and Marvin Grulli) are available to discuss client investment needs.

Call them at 775-284-7778.

Statistics and other information have been compiled from various sources. Universal Value Advisors believes the facts and information to be accurate and credible but makes no guarantee to the complete accuracy of this information.

September 4, 2013

Hidden Inflation Slows Growth, Holds Down Wages

Posted in Inflation, Robert Barone, taxes, Uncategorized tagged CPI, private sector at 7:52 PM by Robert Barone

On Thursday, August 29th, fast-food chain workers conducted strikes in nearly 60 cities asking that chains like McDonalds (MCD), Burger King (BKW), Wendy’s (WEN) and Yum Brands (YUM) (which holds KFC and Taco Bell) boost their minimum hourly pay to $15/hour.

Meanwhile, the saga between Walmart (WMT) and the D.C. City Council continues with Mayor Gray having 10 days from August 30th to sign or veto legislation which requires Walmart (WMT) to pay a minimum wage of $12.50/hour while other employers are only required to pay the D.C. minimum wage of $8.25/hour.

The Income Gap

In 1980, wage earnings as a percent of Gross Domestic Income (GDI, the sister concept to GDP) were 49%. In the last GDI report, they were closer to 42%. Meanwhile, corporate profits are up 50% from about 8% of GDI in 1980 to about 12% today. There is no doubt that the income gap between the rich and the middle class is growing.

The Slide in GDP Growth

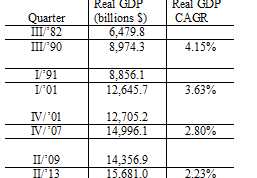

The accompanying table shows the Compounded Annual Growth Rate (CAGR) of Real GDP (as “officially” measured) from the bottom of each of the last four recessions to the following peak.

Source: Department of Commerce

It is notable that the CAGR of Real GDP in today’s recovery (2.23%) is about half the pace in the recovery from the recession of the early ‘80s. Note that in each subsequent cycle since 1982, GDP’s CAGR has slid more than 50 basis points.

The “Official” CPI

In the mid-90s it was determined that demographics would become an issue regarding the cost of social programs like Social Security and Medicare. So, the CPI formulation was changed so as to slow down the “official” rate of inflation, which, in turn, slowed the cost of the social programs.

But there was also an unintended consequence, one not recognized by any politician or the main stream media today. Because the “official” CPI is widely accepted as “the” measure of inflation, and because “cost of living” raises for most of middle America are based on it, its manipulation over time has lowered the real incomes of wage earners (the middle class) with the resulting negative impact on the CAGR of Real GDP, because if the prices of goods and services are actually rising faster than incomes, then aggregate demand is negatively impacted.

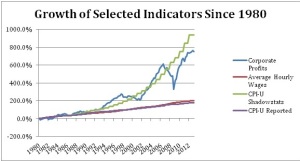

I first published the accompanying graph on August 12th at TheStreet.com (“CPI Manipulation Has Exacerbated the Income Gap”). The graph shows the growth rates in the official CPI, Average Hourly Earnings, Corporate Profits, and the Shadowstats (John Williams) computation of inflation. As you can see from the graph, wages have only kept pace with “official” CPI, but corporate profits have grown more in line with the Shadowstats inflation rate (SGS Alternative CPI, 1980-based), interrupted only by an occasional recession. There are several private sector measurements of true inflation including that published by John Williams. In each private sector survey, the cost of living is shown to be rising significantly faster that the “official” CPI.

Sources: Bloomberg, Federal Reserve Bank of St. Louis, & Shadowstats.com

Conclusion

If the “official” CPI had accurately reported inflation over the past 20 years, it is likely that wage rates today would be significantly higher, that wage earnings would command a larger percentage of GDI, that aggregate demand would be more robust because a larger share of income would be in the hands of those with higher marginal propensities to consume, and that GDP would be growing faster.

For those in Washington D.C. waiting for Mayor Gray to make a political decision about wages for Walmart (WMT) employees, and for those disgruntled fast-food workers who conducted strikes in 60 cities in late August, be careful who you blame. The federal government has the power to remedy the wage situation and the income gap simply by being forthright about the real rate of inflation.

Robert Barone (Ph.D., economics, Georgetown University) is a principal of Universal Value Advisors, Reno, a registered investment adviser. Barone is a former director of the Federal Home Loan Bank of San Francisco and is currently a director of Allied Mineral Products, Columbus, Ohio, AAA Northern California, Nevada, Utah Auto Club, and the associated AAA Insurance Co., where he chairs the investment committee. Barone or the professionals at UVA (Joshua Barone, Andrea Knapp, Matt Marcewicz and Marvin Grulli) are available to discuss client investment needs.

Call them at 775-284-7778.

Statistics and other information have been compiled from various sources. Universal Value Advisors believes the facts and information to be accurate and credible but makes no guarantee to the complete accuracy of this information.