July 20, 2009

A Better Solution to the Debt Crisis

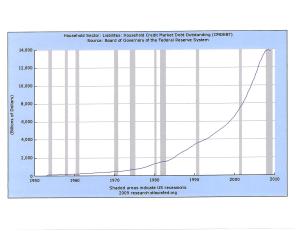

It is widely acknowledged that the crux of the economic crisis in the U.S. is too much consumer debt. The attached chart shows how that debt ballooned over the past decade.

If the government is going to put the country into $6 trillion of additional debt, at least they should aim it at the crux of the problem. $6 trillion is approximately equal to $20,000 per American citizen. Instead of new spending programs in Washington D.C. that do nearly nothing to create new jobs, if U.S. consumers were free of debt, they would begin the spending and create the demand that causes new job creation.

Let the government send each American $20,000 in new coupons. The coupons can only be used to pay off credit card or mortgage debt contracted prior to 6/30/09. The coupons would be convertible at par into U.S. dollars by any holder of credit card or mortgage debt. For mortgage debt, the coupons would be eligible to pay down the mortgage debt to 80% of the current appraised value. The coupons should be freely transferable.

A secondary market for the coupons would immediately develop because there are Americans with little or no debt that would be eligible to use the coupons. I suspect that the coupons would trade for a slight discount. Eventually, the coupons would all disappear as they are converted into cash and the eligible debt is reduced.

Household debt, which now stands at near $14 trillion, would fall to $8 trillion, about where it was in 2001 (see chart) before the easy monetary policies of the Greenspan and Bernanke Fed kicked in. Other benefits include an end to the real estate downward price spirals. With mortgage levels now less than the value of the homes, consumers will feel confident again. The financial system will greatly benefit as the foreclosures lessen, the value of real estate stops falling, and consumer credit delinquencies abate. With credit card debt paid down, the retail sector will benefit, as will manufacturers of retail products. Most important, new consumer demand will create new jobs. Eventually, every sector of the economy will benefit.

In the end, the total debt burden of the nation doesn’t change. It has just been switched from the consumer balance sheet to the government balance sheet. Yes, it burdens future generations, but current policies are doing that anyway. However, with a growing economy instead of a stagnant one, tax collections will rise faster and the debt burden will be easier to deal with.

Robert Barone, Ph.D.

Matt Marcewicz

| Ancora West Advisors LLC is a registered investment adviser with the Securities and Exchange Commission of the United States. A more detailed description of the company, its management and practices are contained in its registration document, Form ADV, Part II. A copy of this form may be received by contacting the company at: 8630 Technology Way, Suite A, Reno, NV 89511, Phone (775) 284-7778 |

Recession’s End Doesn’t Mean the Stock Market Is Out of the Woods

Jobless claims and continuing claims have peaked. Housing has bottomed. Auto sales are turning up. The alphabets (ISM, LEI, NAPM, MBA purchases, ICSC retail sales, etc.) are improving. The recession has bottomed. Hurrah.

Now what?

Historically, the past recessions since WW II had textbook stock recoveries. The recession ends and stocks rally as the economy recovers. The last recession ended in November, 2001. However, the stock market subsequently plunged. It hit lows in July, 2002 and October, 2002. It finally bottomed in March 2003, almost 1.25 years after the recession officially ended.

The last 2001 recession wasn’t even a recession (did we even have 2 consecutive down GDP months?). It lasted only 8 months. Yet, the S&P dropped 49% from peak to trough from March 2000 to March 2003. Three years.

Can we duplicate another housing, consumer spending, home equity withdrawal boom to recover as we did from 2003-2007? We must remember that 70% of the GDP is dependent on the American consumer. How is he doing?

It has been one year and 8 months since the October 2007 market top. Only one year and 4 months to go to equal the last bear market duration. Greenspan kept fed funds below 2% for 3 years. Can Bernanke continue to just pin rates at near zero for years until we recover? Why not? Seems so easy, doesn’t it? Has the government pumped in enough money to mark the S & P stock market the low in March at 666?

Fred Crossman, J.D, C.P.A.

| Ancora West Advisors LLC is a registered investment adviser with the Securities and Exchange Commission of the United States. A more detailed description of the company, its management and practices are contained in its registration document, Form ADV, Part II. A copy of this form may be received by contacting the company at: 8630 Technology Way, Suite A, Reno, NV 89511, Phone (775) 284-7778 |

July 16, 2009

Be Careful of Consumer Stocks

Many consumer stocks have rallied to 52 week highs (when the Dow was at 13,000 and the S&P around 1300). Many have doubled and tripled while the S&P recently peaked to around 950, up 40% from its March low.

Consumer stocks historically lead a recovery and stock market rally. However, many are way ahead of the indexes and imply a return to 15-20% growth, as indicated by their 15-20 P/E ratios. Furthermore, many of these consumer stocks pay no dividend.

True retail sales (ex gasoline) of restaurants, apparel, travel, etc are down 4 months in a row. The consumer is constrained by job losses and mortgage woes. I do not believe the American shopper will return to his/ her past free spending ways as many of the consumer stocks indicate he will.

As an example, J Crew (JCG) has more than tripled from it $8 low to $27, near its 52 week high. Sporting a near 40 P/E, trading at 18 times cash flow and 6.6 times book value, this consumer stock is priced to perfection.

JCG is a consumer stock with a thin 3% profit margin (60% less than the typical S&P company). The current price implies the US retail sector will more than rebound to its former 2008 level when JCG’s operating earnings and net earnings were 80% higher.

Fred Crossman, J.D, C.P.A.

Joshua Barone, Managing Partner Ancora West Advisors

| The mention of companies in this article should not be considered as an offer to sell or a solicitation to purchase any securities of the companies mentioned. Please consult an Ancora West Investment Professional on how the purchase or sale of securities can be implemented to meet your particular investment objectives goals.

Ancora West Advisors LLC is a registered investment adviser with the Securities and Exchange Commission of the United States. A more detailed description of the company, its management and practices are contained in its registration document, Form ADV, Part II. A copy of this form may be received by contacting the company at: 8630 Technology Way, Suite A, Reno, NV 89511, Phone (775) 284-7778 |